Over the last four decades, consumption of milk in the US has changed.

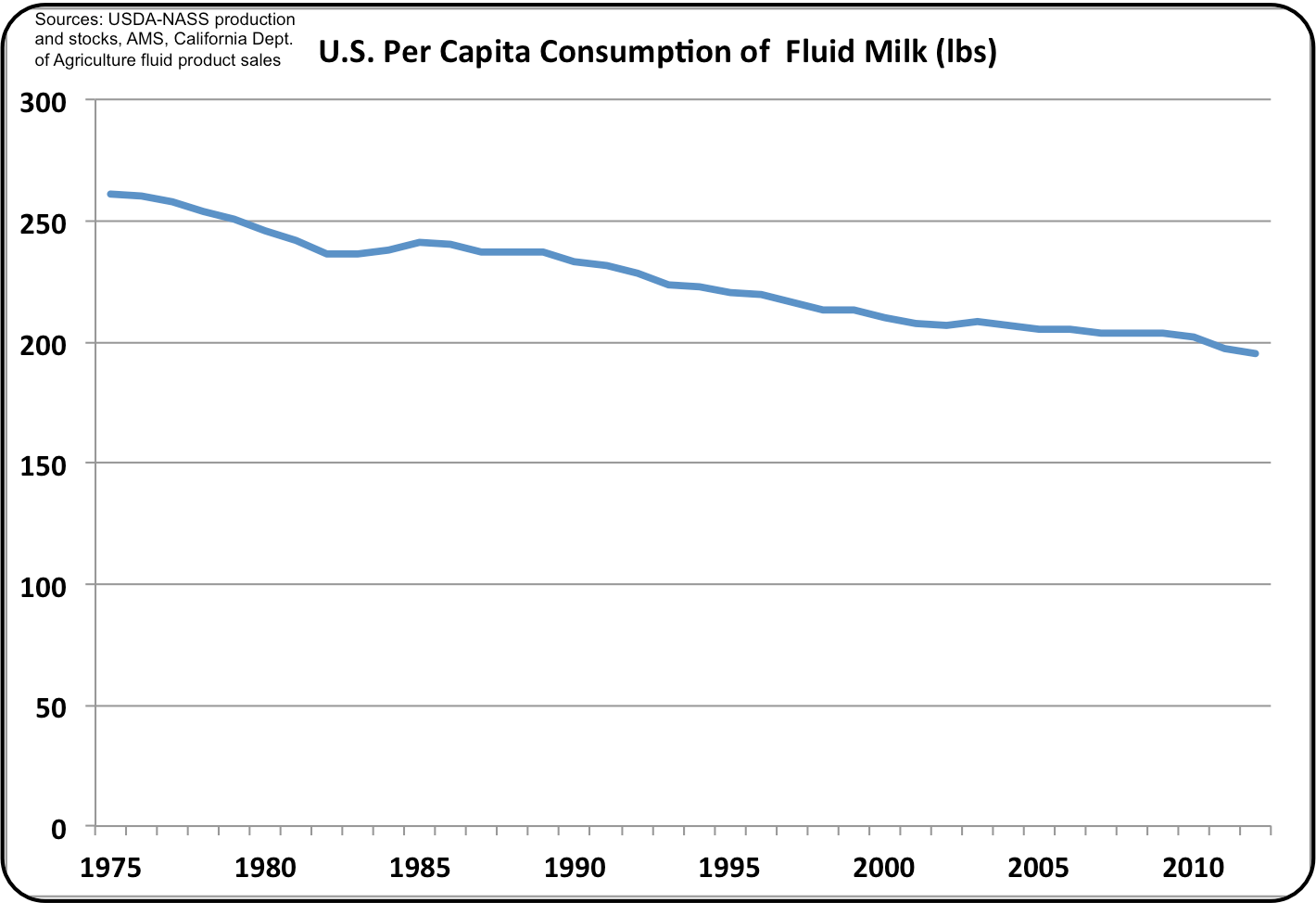

Consumer trends show a continually shrinking per capita consumption, down 25% since 1975. This decreasing consumption will no doubt continue.

Competition for alternate beverages continually intensifies with the introduction of new products. The trends indicate a reduction of 28 oz (830 ml) of milk per person every year.

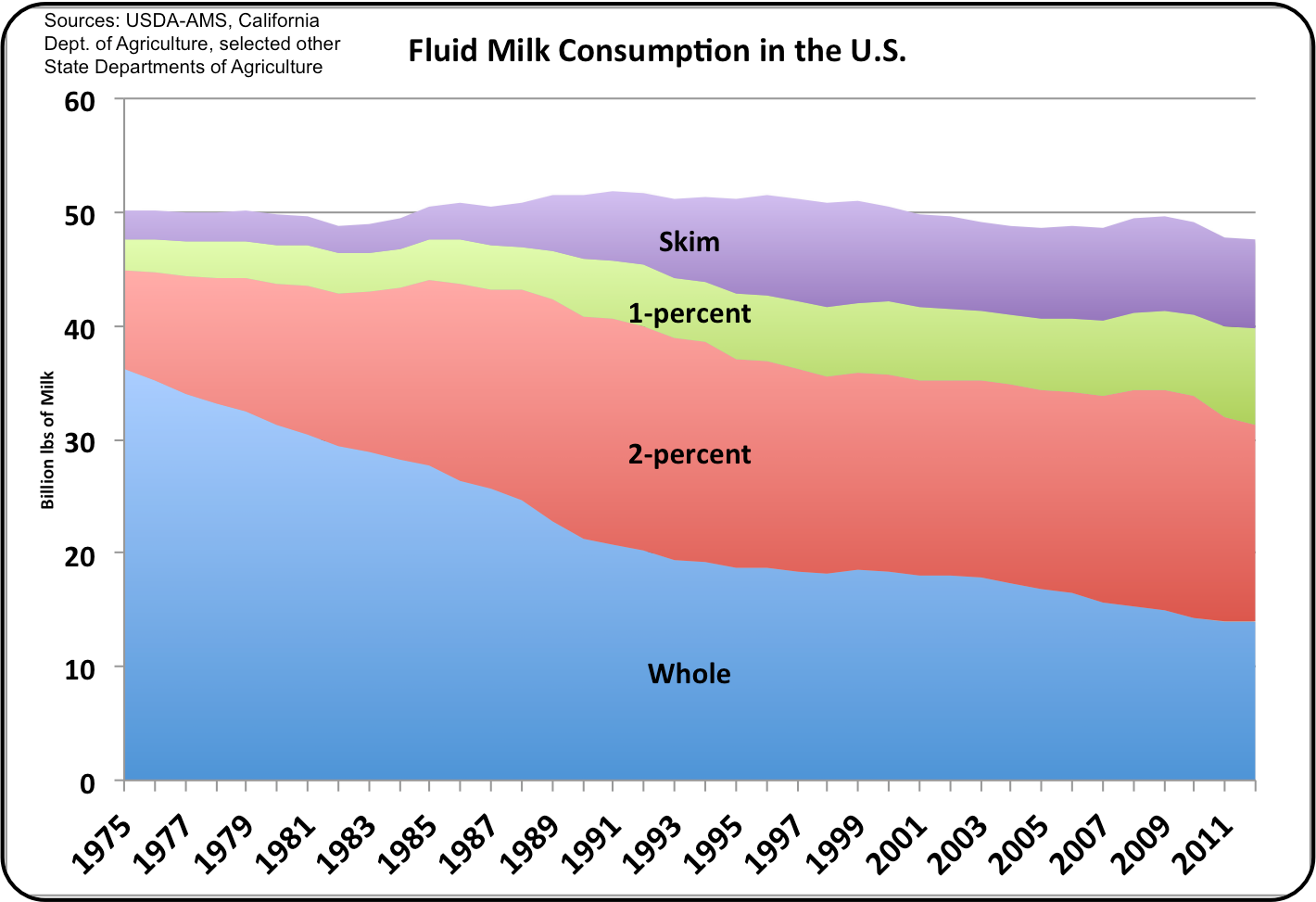

The composition of this milk is also changing. In 1975, whole fat milk made up the majority of milk consumed (68%). Today, whole fat milk makes up only 26% of milk sales with 2% fat milk now the market leader with 33% of total milk sales.

There is no reason to expect changes in the shrinking share of market for whole milk. The only unknown is which of the three forms of reduced fat milk will grow fastest. Recent data suggests a change from 2% fat milk to 1% fat milk.

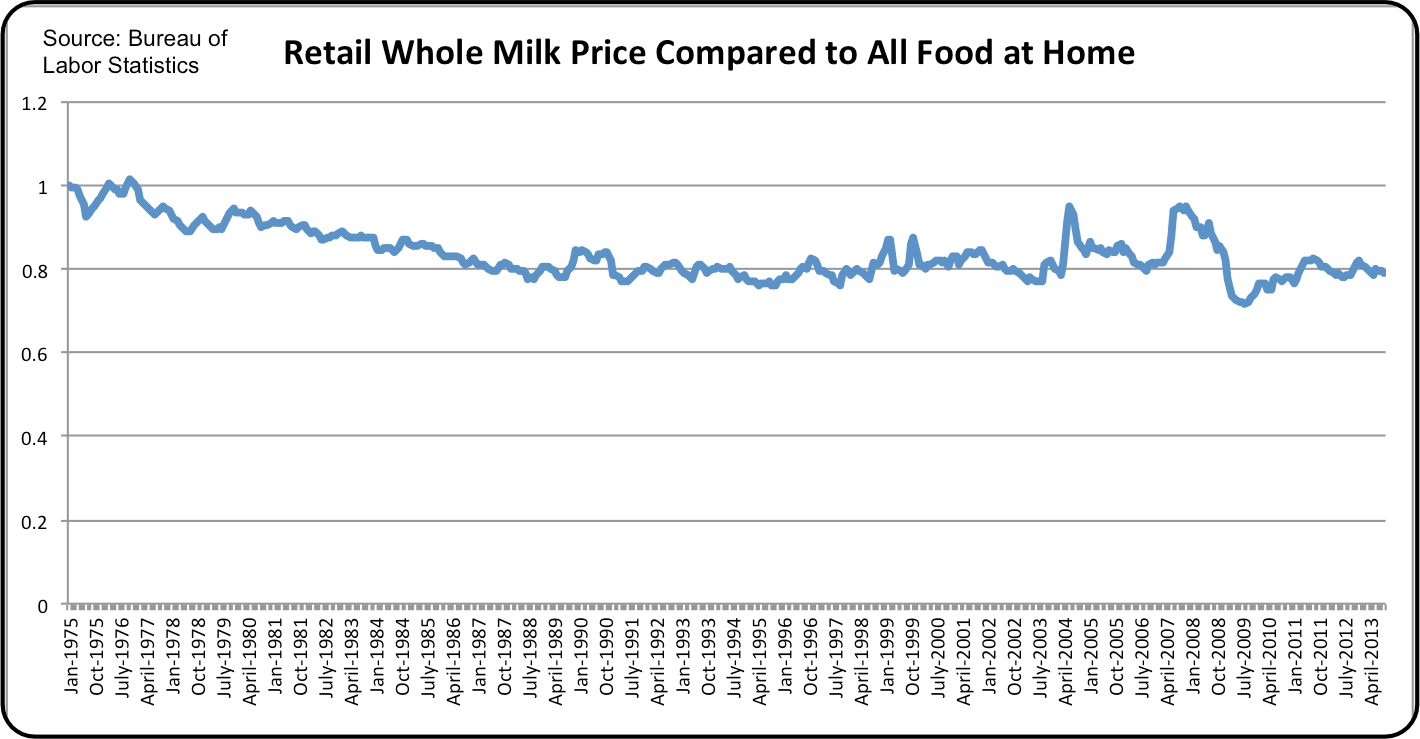

The retail price of milk is not responsible for this loss of per capita consumption. The consumer price of milk has decreased as compared to the overall Consumer Price Index for 'prepared at home' food.

Since 1975 the relative price of milk has decreased 20% as compared to expenditures for all food items. Increasing milk prices could be responsible for decreasing demand, but the data shows that the price of milk is not increasing.

Therefore the decrease in milk consumption is clearly a change in consumer buying and consumption habits.

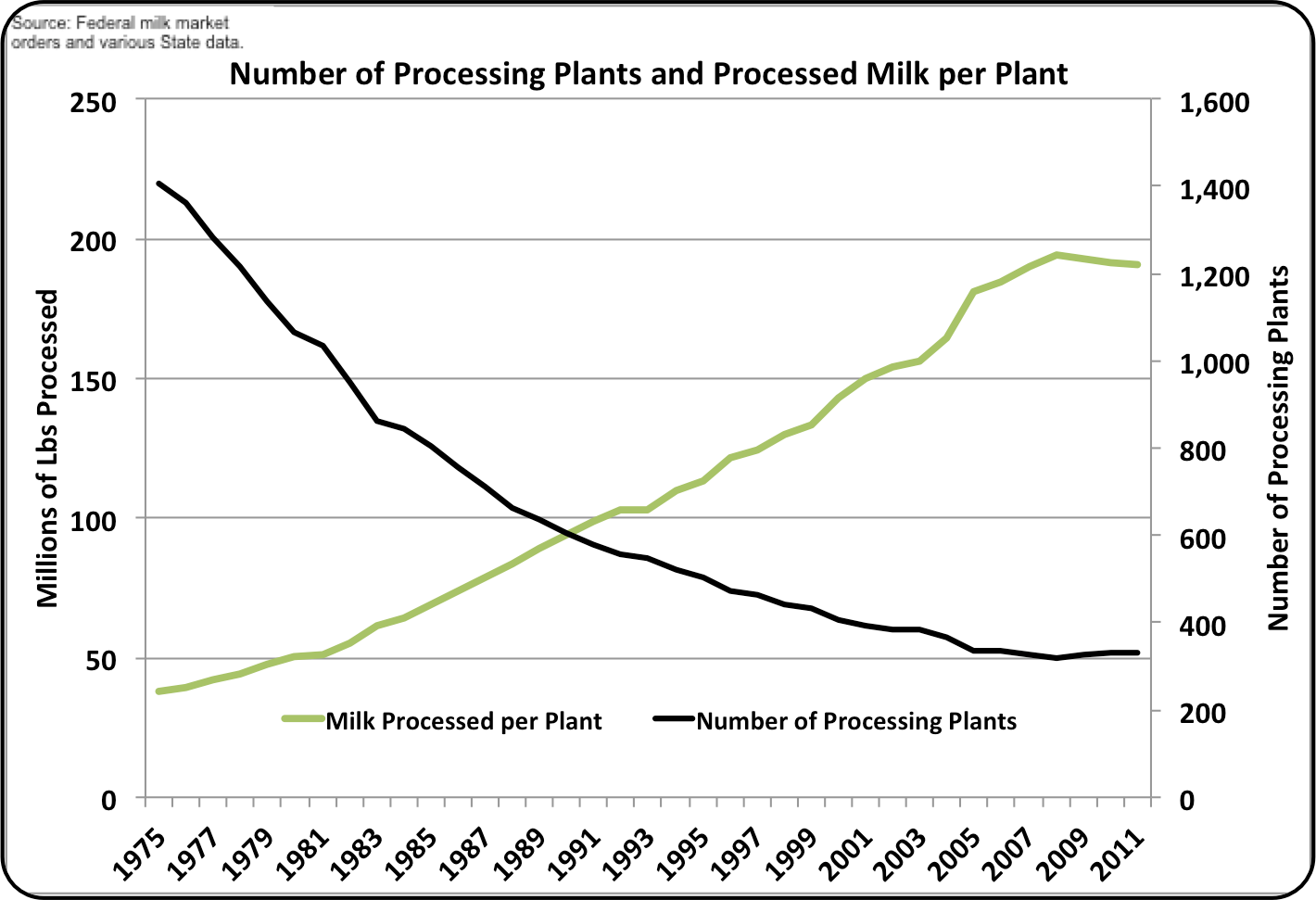

There are also significant changes in processing of drinking milk. There are fewer and fewer processing plants but the size of these facilities has increased dramatically.

Since 1975, the number of processing plants has decreased by 87% and the output of these facilities has increased by 500%. Fewer but larger plants are an indication of the industry’s efforts to reduce cost and increase processing efficiency.

Over time, there have been efforts to change the trend of decreasing milk consumption. Flavored milk like chocolate and strawberry have been available during the entire time span of this analysis. More modern packaging has been developed to improve the image and attractiveness of milk.

Expenditures for advertising have increased and have made the 'milk mustache' an easily recognized symbol of milk drinkers.

However, none of these actions has changed the consumption trends and there is no reason to think that the decreasing trends will not continue.

The focus of the dairy producer needs to change from one of milk volume to one of milk components.

The growing US export market for dairy products does not include drinking milk because it is too expensive to ship water. US growth in domestic dairy consumption is coming from processed dairy products like cheese and yogurt, not drinking milk.

The US dairy industry must focus on component production, not milk volume. While this seems obvious, producer discussions almost always focus on the volume of milk, not the component output or the individual component levels.

John Geuss is the editor of US dairy commodities blog, MilkPrice.

For in-depth month-by-month examinations of American dairy commodity movements, visit MilkPrice.