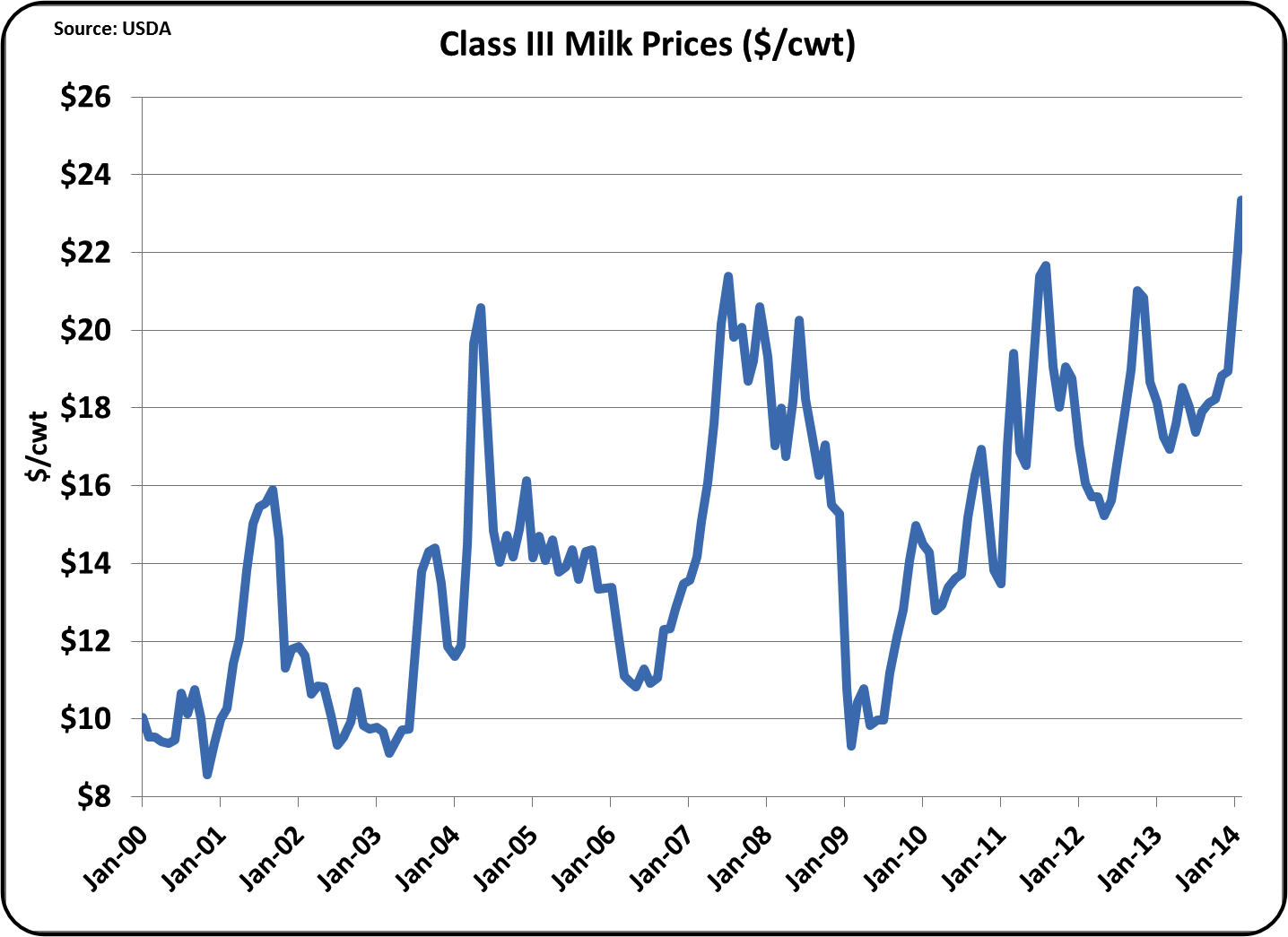

US dairy producers are receiving record high prices for their milk.

The majority of US producers are paid on a component basis where they receive payment only for milk protein, milk fat, and other solids. This is referred to as the Class III milk price.

February 2014 prices were released March 4, 2014. For February, that price was $23.35 per hundredweight (cwt). This is an all time record high.

There is a chain of events causing this record price, which is traced back to its source in the analysis below.

The record high milk price is Level 1 in the drill down process.

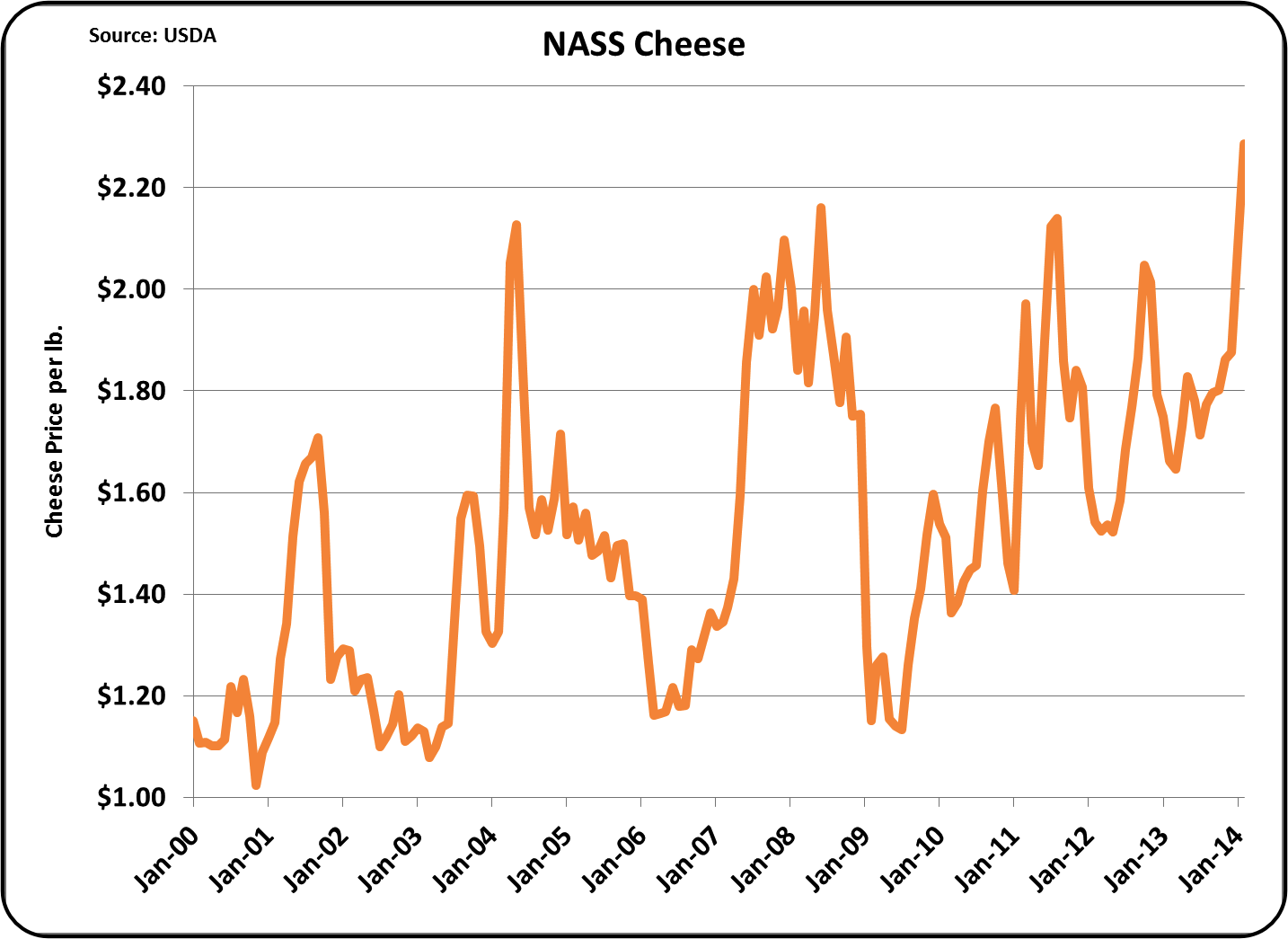

Level 2 - The Class III price is based primarily on the wholesale price of cheddar cheese as determined by the National Agricultural Statistical Survey (NASS). That price was also a record high which in turn drove the Class III milk price to its record.

What is causing these record prices?

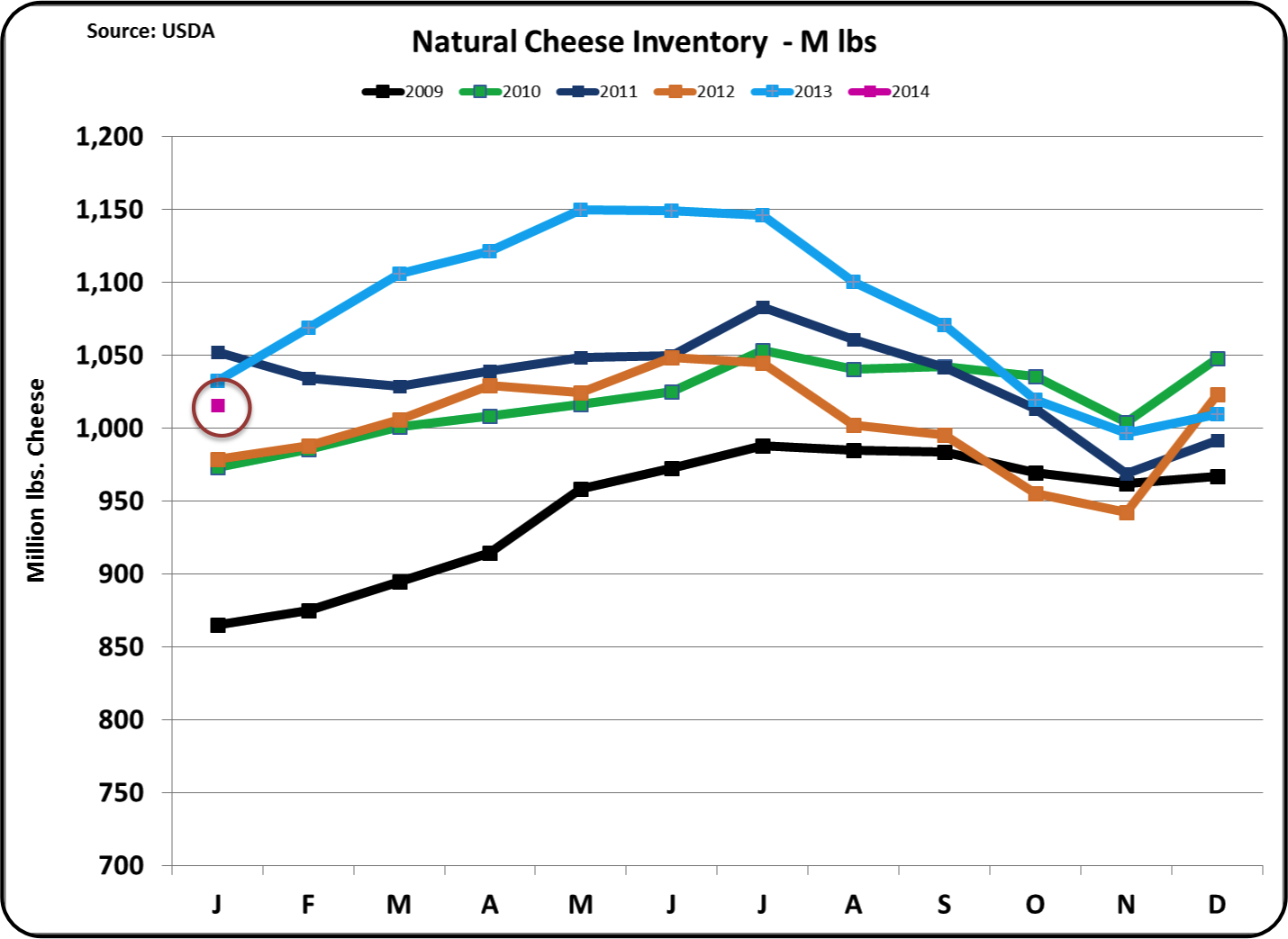

Level 3 - Inventories of cheese are very low. January month end data shows cheese inventories below the prior year.

Level 4 – A lower inventory level must result from decreased production or increased demand.

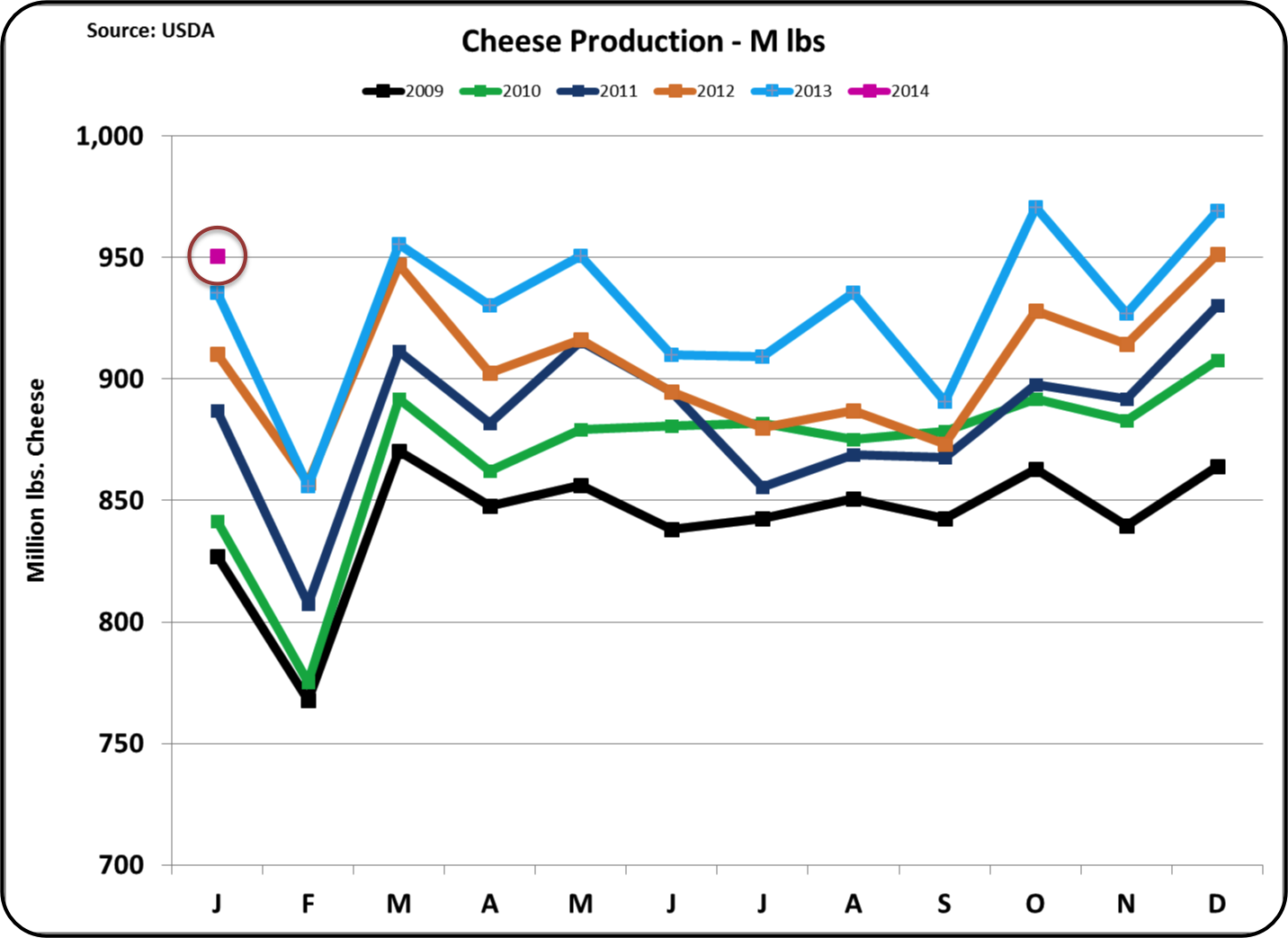

The chart below shows the US cheese production through January 2014.

Cheese production set a record high for January, so production of cheese is not the issue.

The next question in the chain would be what is driving demand for cheese.

Exports are the most volatile, so they were examined in the next level.

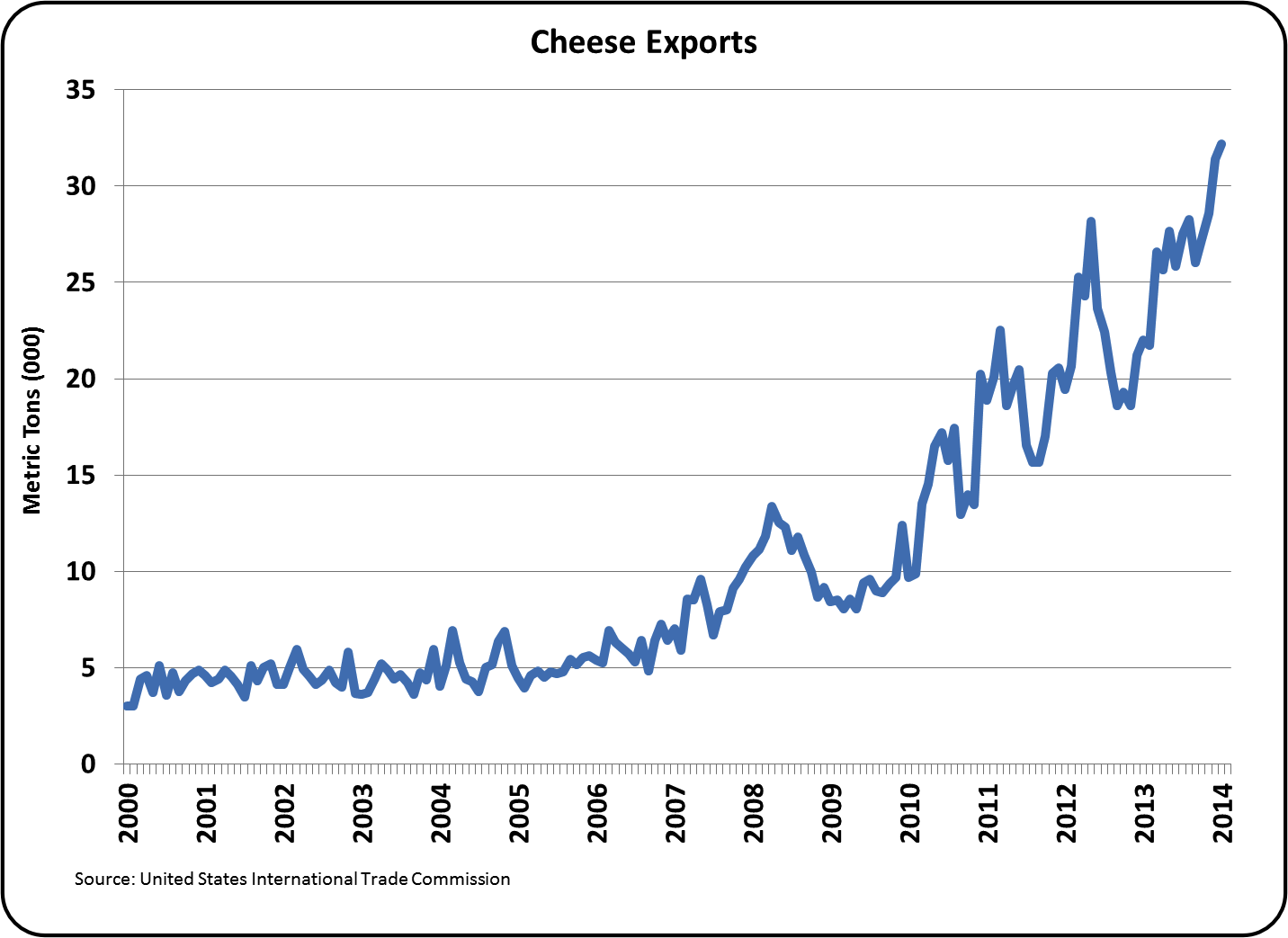

Level 5 – Exports of cheese reached a record high in January 2014.

A total of 32,118 metric tons of cheese were exported in January 2014, an increase of 46% from the prior year period. This represents 7.4% of cheese production, also a record.

Level 6 – Where did the export demand come from?

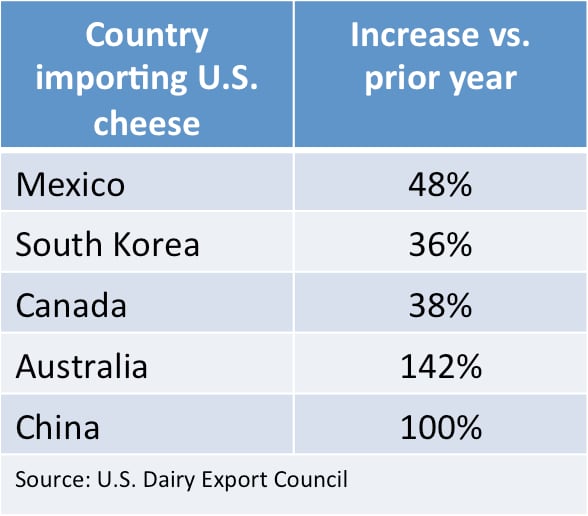

The increases were primarily to the countries where the US has a long history of cheese exports.

Mexico is always the largest importer of US cheese and those imports were up 48% over the prior year. South Korea and Canada also are major long-term importers of US cheese and had year over year increases of 36% and 38% respectively.

The increases from Australia and China are lower volumes, but huge percentage increases as shown in the table below.

In the February 13, 2014 article on DairyReporter.com, the impact of US exports of skim milk powder (SMP) was examined as a driver of US milk prices.

While SMP remains a milk price driver in February, cheese exports were the biggest contributors.

John Geuss (left) is the editor of US dairy commodities blog, MilkPrice.

For John's detailed month-by-month examination of American dairy commodity movements, visit MilkPrice.