How would the global dairy industry look like in 2025? We round-up the latest dairy and products annual data published by the USDA to get a glimpse of what’s to come in 2025.

Robust global demand for dairy is expected to remain in place as producers seek to improve production efficiencies and boost milk solids. In markets such as the the EU, New Zealand and Australia, a shrinking dairy herd poses a challenge, in addition to climate and seasonal variations.

New Zealand

In New Zealand, milk production is forecasted to drop in 2025 to 21.3 million metric tons (MMT), down from the five-year average of 21.5 MMT.

Export focus

Just over 2% of New Zealand’s milk is consumed domestically.

Producers’ recent shift from powder to fresh dairy such as butter and cheese has led to a decrease in powder exports, with the share of WMP exports – the largest dairy commodity product made in the country - down from 45% in 2019 to 41% in volume terms in 2024. However, an almost 4% year-to-date increase in WMP exports over 2023 suggests that increased demand in markets, such as UAE and Bangladesh, has offset the decrease in exports to China (-5.5%) and Algeria (-18%).

At the same time, producers have ramped up production of expensive, speciality products such as infant formula, protein concentrates, lactoferrin and caseinates. In the first eight months of 2024, exports for these products combined were tracking +13.8% YoY.

Australia

In Australia, milk production for 2025 is expected to increase by 1.1% to 8.8MMT, following on 2.7% growth for 2024. Milk consumption is expected to rise, reversing a 5-year decline, though much of that milk is likely to go into cheese production. Exports of SMP, WMP, and butter are forecast to moderate in 2025 after strong results so far in 2024.

Cheese production – a major focus for dairies in the past decade – is expected to return to 2023 levels (375,000MT) after a drop in output in 2024. Exports are projected to decline to 150,000MT, down from 165,000MT in 2024.

Butter production is also expected to rise slightly, with SMP and WMP expected to moderate in 2025.

China

China’s increased milk production is creating ripples on the global dairy commodities market. The largest global dairy buyer is importing less dairy and, coupled with the nation’s declining birth rates and increased milk self-sufficiency, this trend is unlikely to change in the new year. Imports of fluid milk, whey, butter, WMP and SMP are estimated to all decline in 2024; but cheese imports may stay flat over limited domestic production.

An anticipated trade war with the US could put US dairy in the crossfire again, if China retaliates similarly to last time when the country hit US-imported milk and milk product with tariffs ranging from 5% to 27.5%. China is also in the midst of an anti-subsidy investigation into European dairy products; the probe is expected to continue through most of 2025 and could be further extended. Because of this, RaboResearch forecasts that a market impact is not likely until at least 2026.

India, the world’s largest dairy producer, is set to continue to grow its output in 2025, according to USDA FAS data. Total milk production is likely to rise to more than 216mmt thanks to a growing herd size and increased government backing for the sector, favorable weather conditions and high milk prices. Coupled with rising disposable income and a growing population, consumption of milk, butter and SMP are all likely to increase. In rural regions, it remains below official dietary recommendations.

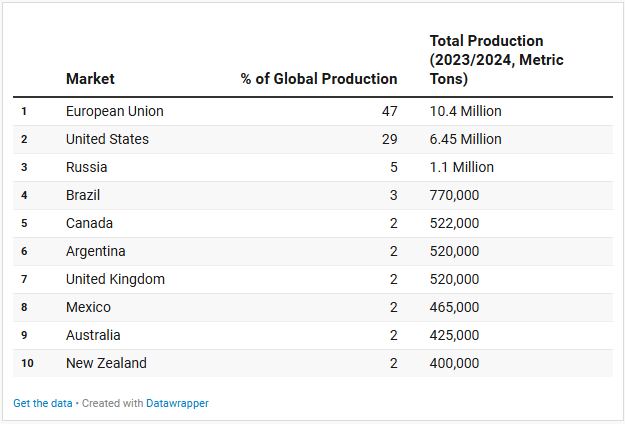

Global demand for cheese continues to grow at 2% per year, according to USDA FAS estimates, with the EU (43%) and the US (29%) being the biggest consumers but also producers, as shown in the table below.

European Union

Cheese production is set to remain a key focus for EU dairy processors as the industry decides which products it should pool milk into, as fluid milk production is expected to decline to 148.9MMT in 2024 from an estimated 149.3MMT a year prior. Cheese production meanwhile is expected to increase by 0.6% to 10.62MMT, but this will impact butter, nonfat dry milk (NFDM) and WMP production.

While around half of EU-produced NFDM is exported, the USDA estimates a decline of 7.6% in 2024 from 2023 levels due to lower production and weaker Chinese demand but also heavier competition from the US and New Zealand.

WMP production is forecast to decline in 2024 by 3.9% and exports are also expected to drop below 2023 levels as production is directed to the domestic market.

Butter production was forecast 2.1% below 2023 levels due to limited milk availability for butter and consumer trends negatively weighing on demand. Butter exports in 2024 are also expected to decline.

Earlier this month, the EU agreed an FTA with Mercosur that could offer a new route for powder exports – more on this here. Meanwhile, requirements forming part of the new Common Agricultural Policy (CAP) and the EU Green Deal will remain in sharp focus for agrifood producers, particularly as additional investment in improving sustainability could negatively impact profits.

The US

In the US, milk production forecasts for both 2024 and 2025 have been revised up thanks to expected increase in the dairy herd. According to the most recent USDA National Agricultural Statistics Service Milk Production report, the October milk cow herd was 9.365 million head, 10,000 more than last October – the first month since May 2023 showing a year-over-year increase in the dairy herd size, though month over month, the herd had been increasing since August 2024.

In 2025, the herd is forecast to continue expanding by 30,000 head to 9.390 million, leading to an increase in the 2025 milk production forecast of 0.3 billion pounds.

Based on recent trade data, the 2024 export forecast is increased to 11.7bn lb (+0.1bn) on a milk-fat basis due to higher anticipated cheese and butter exports. On a skim-solids basis, the forecast is reduced by 0.1 billion pounds due to lower anticipated exports of dry skim milk products and dry whey exports on less competitive prices; though lactose exports are expected to increase.

The 2025 US dairy export forecast is projected at +0.1bn lb driven by butter and cheese exports; but declines in dry skim milk product exports of around 0.4bn lb are also anticipated. Meanwhile, the US is expected to import more cheese, butter and WMP, with 0.1bn lb increases on both milk-fat and skim-solids basis.

Adjusted 2025 price forecasts include: cheddar cheese $1.800 (-9.5 cents), NDM $1.300 (+4.0 cents), dry whey $0.595 (+7.5 cents), and butter $2.685 (-7.0 cents).

These price adjustments have led to a decrease in the 2025 Class III milk price forecast to $18.80 per cwt and an increase in the 2025 Class IV milk price forecast to $20.40 per cwt. The 2025 all-milk price forecast has been lowered to $22.55 per cwt. Meanwhile, the 2024 all-milk price forecast has been lowered to $22.65 per cwt due to decreased 2024 Class III milk price and unchanged Class IV milk price forecasts.

See also: Trump’s trade and immigration policies could spell trouble for US dairy